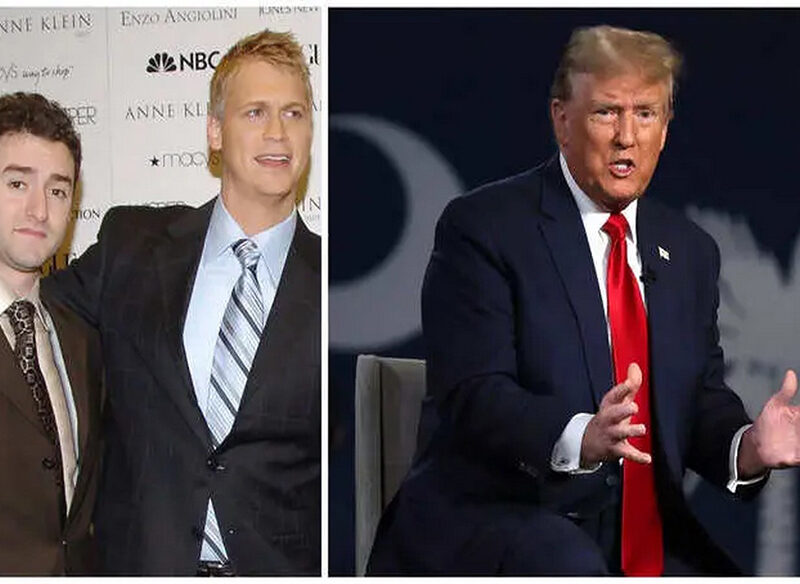

Two former contestants of “The Apprentice” and cofounders of Trump Media, Andy Litinsky and Wes Moss, have filed a lawsuit alleging that executives within the company conspired to diminish their stake in anticipation of a potential merger.

Legal Action by United Atlantic Ventures

Litinsky and Moss, representing their partnership United Atlantic Ventures (UAV), filed the lawsuit, claiming that company executives, including former President Donald Trump, engaged in corporate maneuvers to dilute their ownership ahead of a merger. The lawsuit accuses them of attempting to deprive Litinsky and Moss of shares that could be worth hundreds of millions of dollars.

Allegations of Manipulation

According to the lawsuit, executives, including Trump, orchestrated last-minute efforts to dilute Litinsky and Moss’ stake in the company by increasing the amount of authorized stock from 120 million shares to 1 billion shares. This move would significantly reduce their ownership to less than 1% just before the merger with blank-check company Digital World Acquisition.

Potential Financial Impact

Digital World Acquisition’s Securities and Exchange Commission filing suggests that Trump’s shares could be valued at over $3 billion post-merger, with UAV’s stake estimated at nearly $300 million. This substantial financial gain would be significant for Trump, who faces considerable legal expenses exceeding $450 million.

Board Decisions Under Scrutiny

The lawsuit also alleges that the Trump Media board intended to allocate new shares to Trump, his associates, and children, further diminishing Litinsky and Moss’ ownership. Previous reports indicated that Trump had requested Litinsky to surrender some shares to his wife, Melania, which Litinsky declined.

Ongoing Legal and Regulatory Challenges

Litinsky and Moss departed Trump Media following a dispute with company leadership but retained their shares. The attempted merger between Trump Media and Digital World Acquisition Corp has faced persistent delays, including SEC investigations into potential securities violations. As the merger approaches its final shareholder vote, legal obstacles continue to impede its progress.

Comments