London-based insurance technology (insurtech) startup, Hyperexponential, has successfully raised $73 million in a Series B equity funding round. Led by Boston-based venture capital firm Battery Ventures, the round also saw participation from existing investor Highland Europe and Andreessen Horowitz (a16z). Established in 2017, Hyperexponential specializes in providing “decision intelligence” solutions for the property-casualty (P&C) insurance industry, aiding insurers and reinsurers in making informed pricing decisions through predictive data analytics and insights.

Decision Intelligence for Pricing

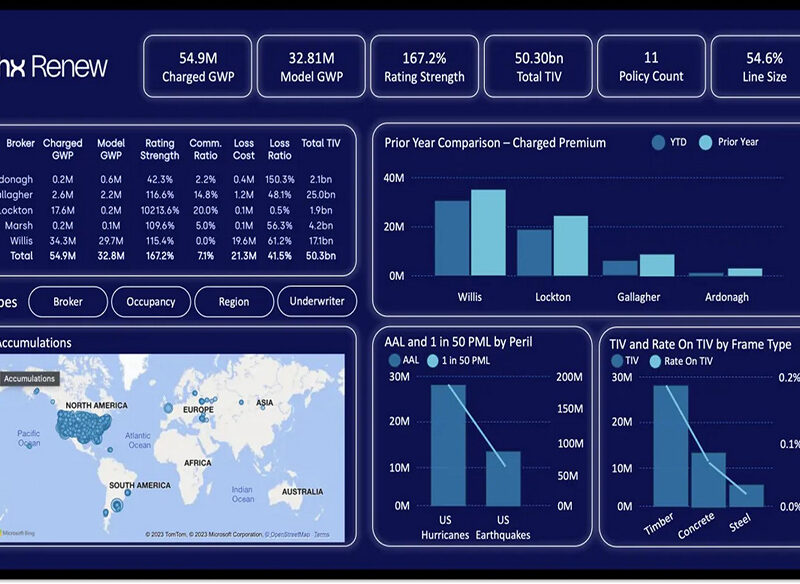

Hyperexponential’s core offering, HX Renew software, empowers insurers by enabling them to construct predictive models and access APIs to integrate data sources and workflows seamlessly. Utilizing automation and machine learning capabilities, the software assists in assessing risks and deriving actionable insights from constantly evolving data landscapes. By leveraging predictive data analytics, insurers can enhance pricing strategies and optimize decision-making processes.

Expansion Plans and Growth Trajectory

The substantial funding secured by Hyperexponential underscores its impressive growth trajectory and strategic vision for expansion. With a ten-fold increase in sales since its inception and profitability, the company has garnered a notable client base, including insurance giant Aviva. This latest investment not only reaffirms Hyperexponential’s market position but also signals its intent to expand beyond its current operations in the U.K. and Poland into the lucrative U.S. market.

International Roadmap and Market Penetration

Hyperexponential’s expansion plans align with its mission to establish a global footprint and capitalize on emerging opportunities in the insurance sector. CEO Amrit Santhirasenan emphasizes the company’s commitment to sustainable growth and strategic market penetration. The decision to collaborate with high-profile U.S. VC firms underscores Hyperexponential’s ambition to leverage expertise and resources for penetrating new verticals and geographies.

Targeted Growth and Industry Focus

While the cryptocurrency and blockchain sectors remain within a16z’s purview, the firm’s recent investment in Hyperexponential reflects a broader focus on technology-driven solutions addressing real-world industry challenges. With the P&C insurance market valued at $1.8 trillion, Hyperexponential’s value proposition resonates with venture capital firms seeking investment opportunities in established sectors with substantial growth potential.

Future Prospects and Expansion Initiatives

Armed with a significant capital injection and support from prominent VC firms, Hyperexponential is poised to embark on its global expansion journey. Plans to establish a New York office and double its workforce highlight the company’s ambitious growth agenda. Moreover, Hyperexponential aims to diversify its offerings by venturing into adjacent markets, including SME insurance, further solidifying its position as a leading player in the insurtech landscape.

Comments