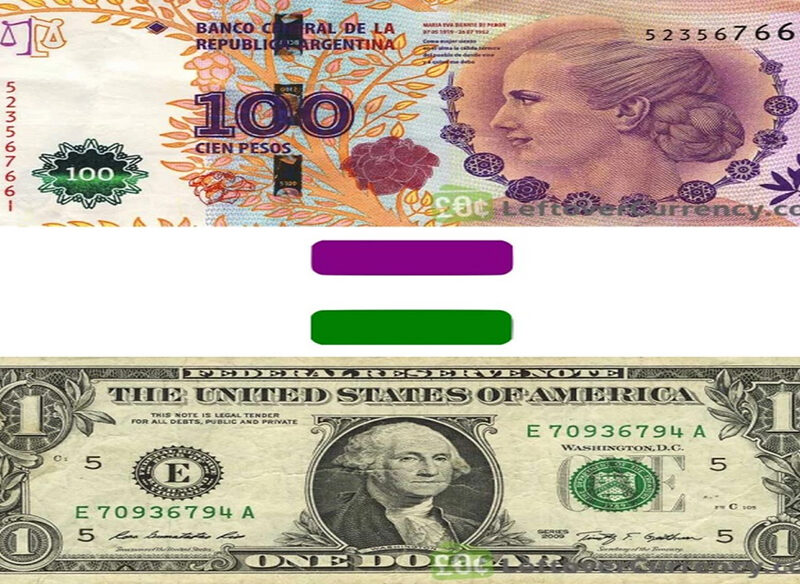

The recent milestone reached by the Argentine peso, with its value crossing the symbolic threshold of 100 pesos = 1 US dollar (USD) on November 8, 2021, serves as a stark illustration of the efficacy of the purchasing power parity (PPP) theory in predicting currency devaluation.

A Tale of Mismanagement and Devaluation

Argentina, once predicted to ascend to the ranks of advanced nations, has instead grappled with economic instability fueled by populist governance, imprudent borrowing, and fiscal mismanagement. The consequence has been persistent inflation, with the country witnessing a century-long saga of economic woes.

Currency Devaluation in Retrospect

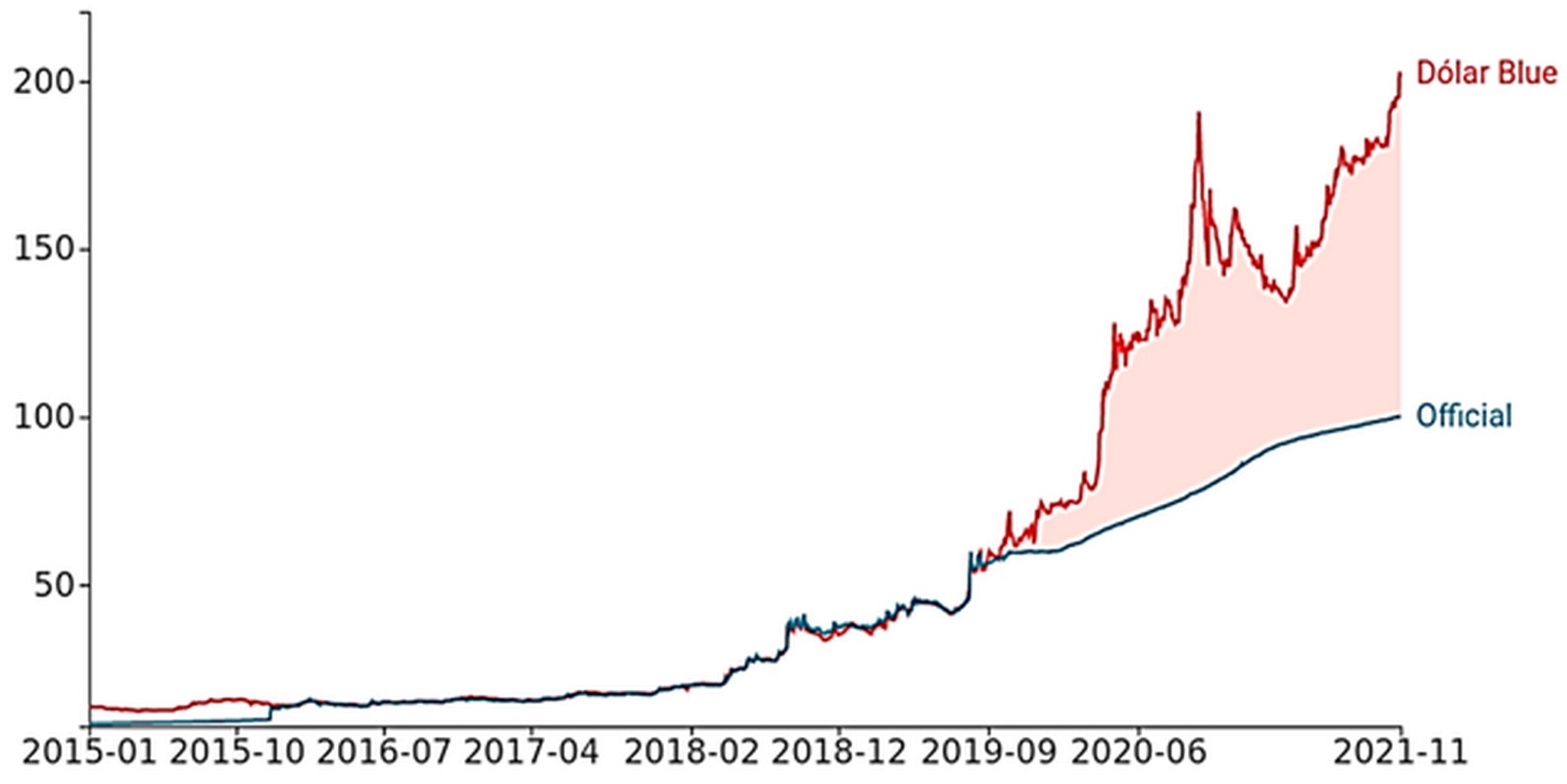

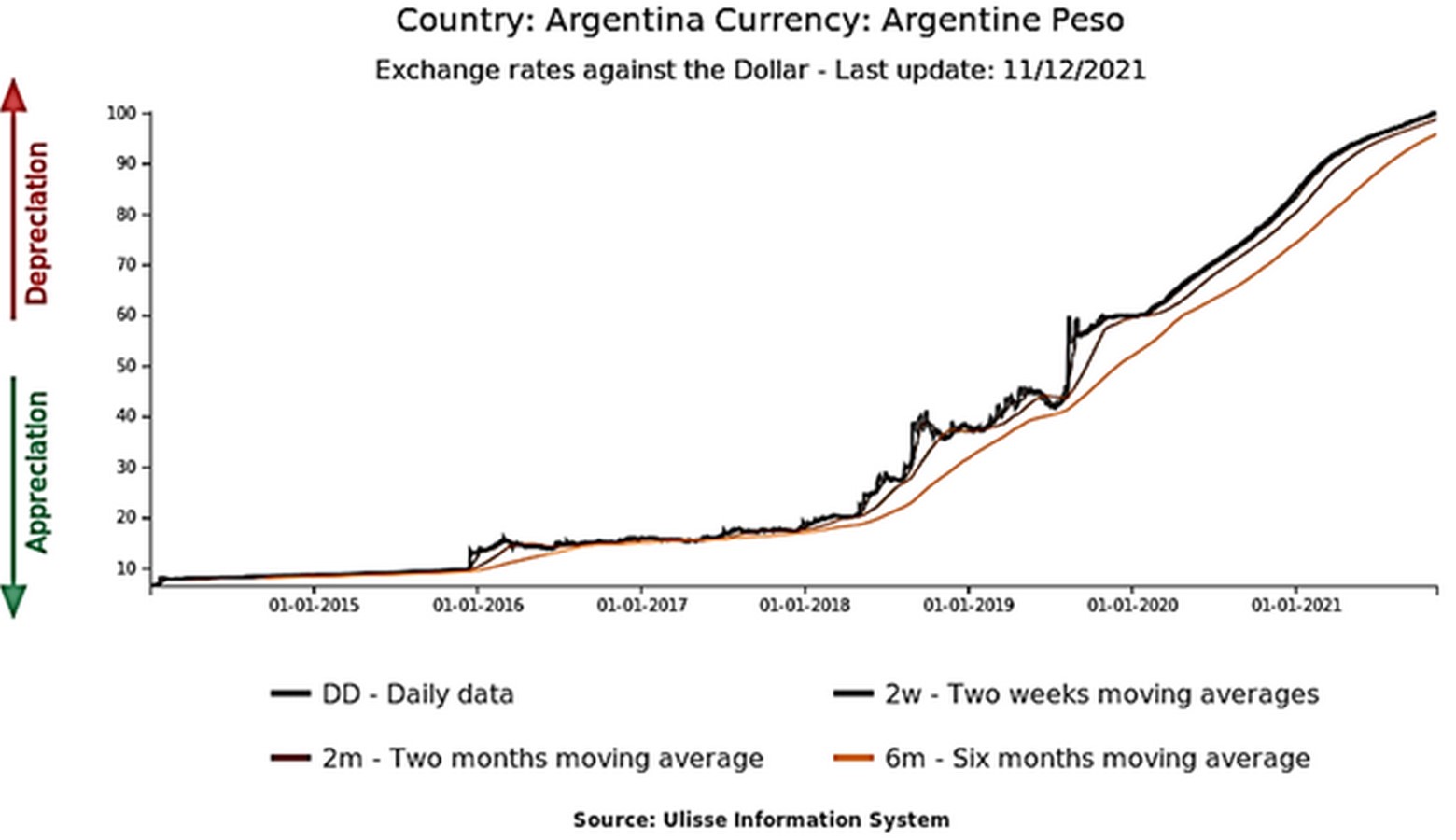

Tracing back two decades, the Argentine peso has undergone a staggering devaluation, transitioning from a parity of 1 peso = 1 USD in 2001 to the recent milestone of 100 pesos = 1 USD. This hundredfold devaluation underscores the currency’s tumultuous trajectory, as depicted in the graph.

Consequences of Overvaluation

The Argentine peso’s historical overvaluation has precipitated adverse economic consequences, including dwindling export revenues, an artificial surge in import demand, and a burgeoning trade deficit. Attempts to sustain this imbalance through borrowing and exchange rate interventions have only exacerbated the country’s economic woes.

Emergence of Parallel Markets and Defaults

In response to the government’s interventions, parallel currency markets have emerged, reflecting the growing strain on the economy. Moreover, Argentina’s recurrent defaults on international debts, despite offering high-interest bonds, have eroded investor confidence and exacerbated currency devaluation.

Lessons for Emerging Economies

Argentina’s predicament serves as a cautionary tale for emerging economies, highlighting the perils of fiscal mismanagement and unsustainable debt burdens. While the implications for advanced economies like the US may differ, the underlying principles of fiscal prudence and debt sustainability remain relevant across contexts.

Conclusion: The Long-Term Validity of PPP Theory

In conclusion, the Argentine peso’s trajectory underscores the enduring validity of PPP theory. Despite short-term interventions and economic fluctuations, the theory holds true in the long run, emphasizing the importance of sound economic fundamentals and prudent fiscal policies in maintaining currency stability and fostering economic prosperity.

Comments